Calculate new jersey sales tax

There are however 32 Urban. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

When Did Your State Adopt Its Sales Tax Tax Foundation

Columbus is located within Burlington County New.

. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. Minus Tax Amount 000. Calculate the tax to the third decimal place as follows.

New Jersey has a 6625 statewide sales tax rate but also has 308 local tax jurisdictions including cities towns counties and special districts that. Find your New Jersey combined state. New Jersey State Tax Quick Facts.

The New Jersey state sales tax rate is 7 and the average NJ sales tax after local surtaxes is 697. New Jersey state offers tax deductions and credits to reduce your tax liability including deductions. Minus Tax Amount 000.

242 average effective rate. This takes into account the rates on the state level county level city level and special level. Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance.

Sales and Gross Receipts Taxes in New Jersey amounts to 163. 20 flowers x 006625 sales tax rate 1325. If you have sales tax nexus in New Jersey and sell to buyers in New Jersey just charge.

Enter an amount into the calculator above to find out how what kind of sales tax youll see in. Just enter the five-digit zip. 2022 New Jersey state sales tax.

The base state sales tax rate in New Jersey is 6625. Exact tax amount may vary for different items. Unlike many states NJ does not allow the imposition of local sales taxthe entire state has a single rate.

The average cumulative sales tax rate in the state of New Jersey is 663. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Wildwood New Jersey. Calculate Sales Tax in New Jersey Example.

1050 cents per gallon of regular. The average cumulative sales tax rate in Columbus New Jersey is 663. The state income tax rates range from 14 to 107 and the sales tax rate is 6625.

Our tax preparers will ensure that your tax returns are complete accurate and on time. Sign Purchases and Installation Services Sales and Use Tax Effective October 1 2022. This includes the rates on the state county city and special levels.

Ad New State Sales Tax Registration. Plus Tax Amount 000. You must collect 2133.

See it in Action. The amount of tax due is more than 500. The New Jersey NJ state sales tax rate is 6625.

20 flowers 133 sales tax 2133. Sales Taxes Nj information registration support. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified.

You are only required to file a monthly Sales Tax return Form ST-51 if. Before Tax Amount 000. Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663.

Usually the vendor collects the sales tax from the consumer as the consumer makes. Groceries clothing and prescription drugs are exempt from the New Jersey sales tax. Collecting sales tax in New Jersey is fairly easy because New Jersey doesnt have local sales tax rates.

Avalara calculates collects files remits sales tax returns for your business. Plus Tax Amount 000. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Sales Tax 40000 - 5000. You collected more than 30000 in Sales and Use.

State And Local Sales Tax Rates Sales Taxes Tax Foundation

State Income Tax Collections Per Capita 2010 Map Income Tax Property Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

New Mexico Sales Tax Small Business Guide Truic

Sales Tax Calculator

Sales Tax Calculator Taxjar

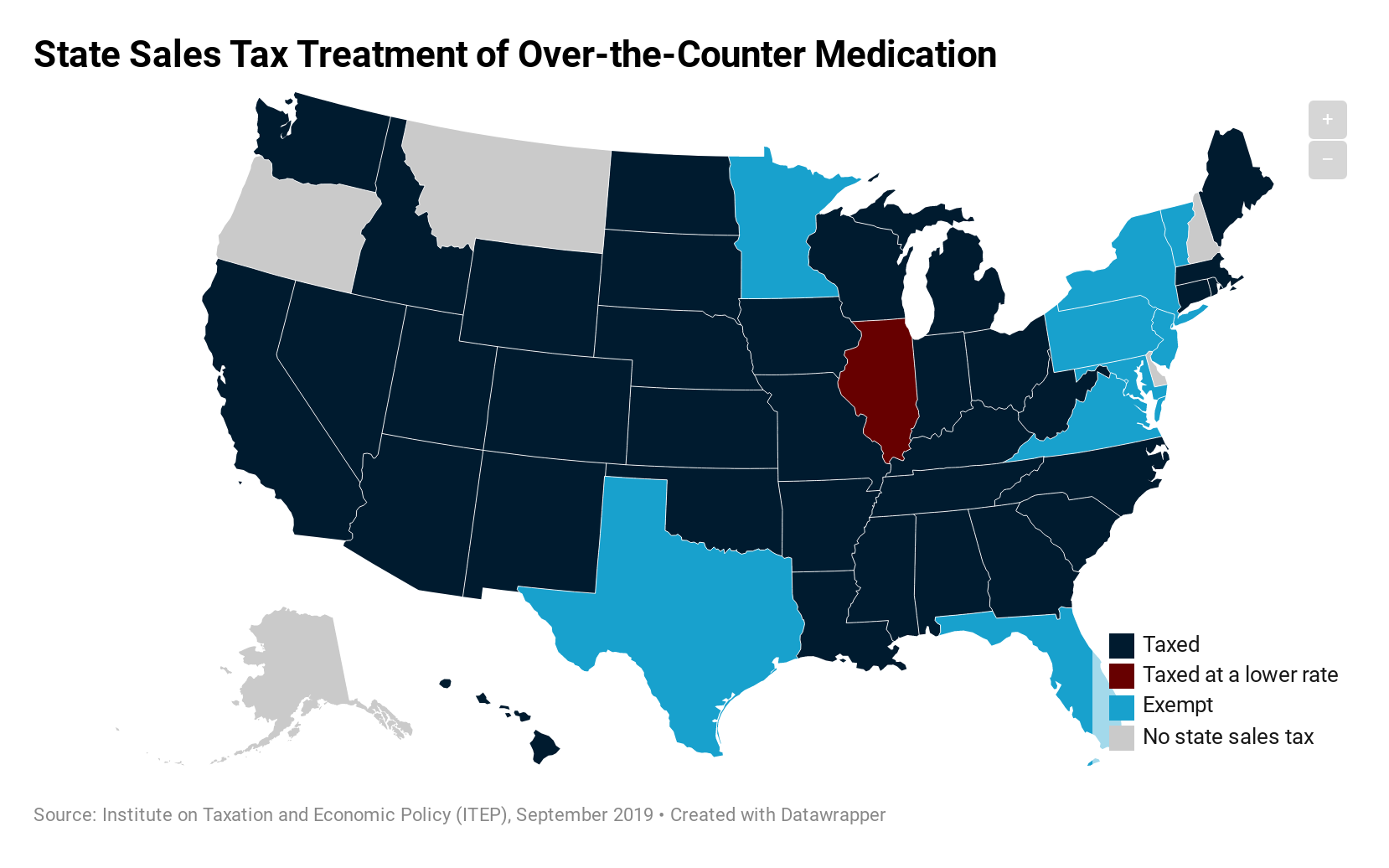

How Do State Tax Sales Of Over The Counter Medication Itep

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Day 30 The Big Day Check List Show Me The Money Money Card Box Checklist

Sales Tax Calculator Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Triple Horseshoe Shelf Bracket Set Dornbach Studios Metal Working Projects Welding Art Projects Welding Projects

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Calculate Sales Tax For Your Online Store

State And Local Sales Tax Rates Sales Taxes Tax Foundation

State And Local Sales Tax Rates Sales Taxes Tax Foundation